SfC engages Hannover RE on climate related issues

“A good start but, after coal, it’s time to extend commitment to the oil sector”

On 2 December, during their winter meeting, SfC members engaged the reinsurance company Hannover RE on climate related issues in a video-call. The engagement session was part of a wider programme of training on how sustainability in the reinsurance industry can be improved, which characterized the agenda of the first day of the meeting and included a dialogue with CAT (Catastrophe) bond fund manager Plenum Investments AG, based in Zurich and the German NGO Urgewald.

Hannover RE, which was recently considered as one of the best insurance and reinsurance companies globally in terms of fossil fuel divestment by the campaign “Insure our Future“, supported by 20 environmental NGOs worldwide, presented its policy on climate and answered to about ten questions from SfC members about the company’s voting strategy in AGMs, investments in the sustainability department, a possible withdrawal from the oil & gas sector (both as reinsurance underwriter and investor) and the scope of reduction of greenhouse emissions in its portfolio.

“We welcome Hannover RE’s readiness to engage in a dialogue with our network“, says Tommy Piemonte, Head of Sustainable Investment Research at Bank für Kirche und Caritas, that is leading the engagement project on behalf of the SfC network. “The first exchange with the company has been positive but some questions remained unanswered, also due to time constraints. Therefore we have detailed all aspects that, in our opinion, should be better explained in a letter that was sent to Hannover RE on 18 December“.

The letter included seven questions, asking more details, among others, on the company’s coal policy, the extension of the CO2 reduction plan for the asset management to scope 3 emissions and the possible plans to extend the exclusion from the underwriting business to controversial shale oil and gas projects, since oil sands and arctic drilling activities have already been excluded.

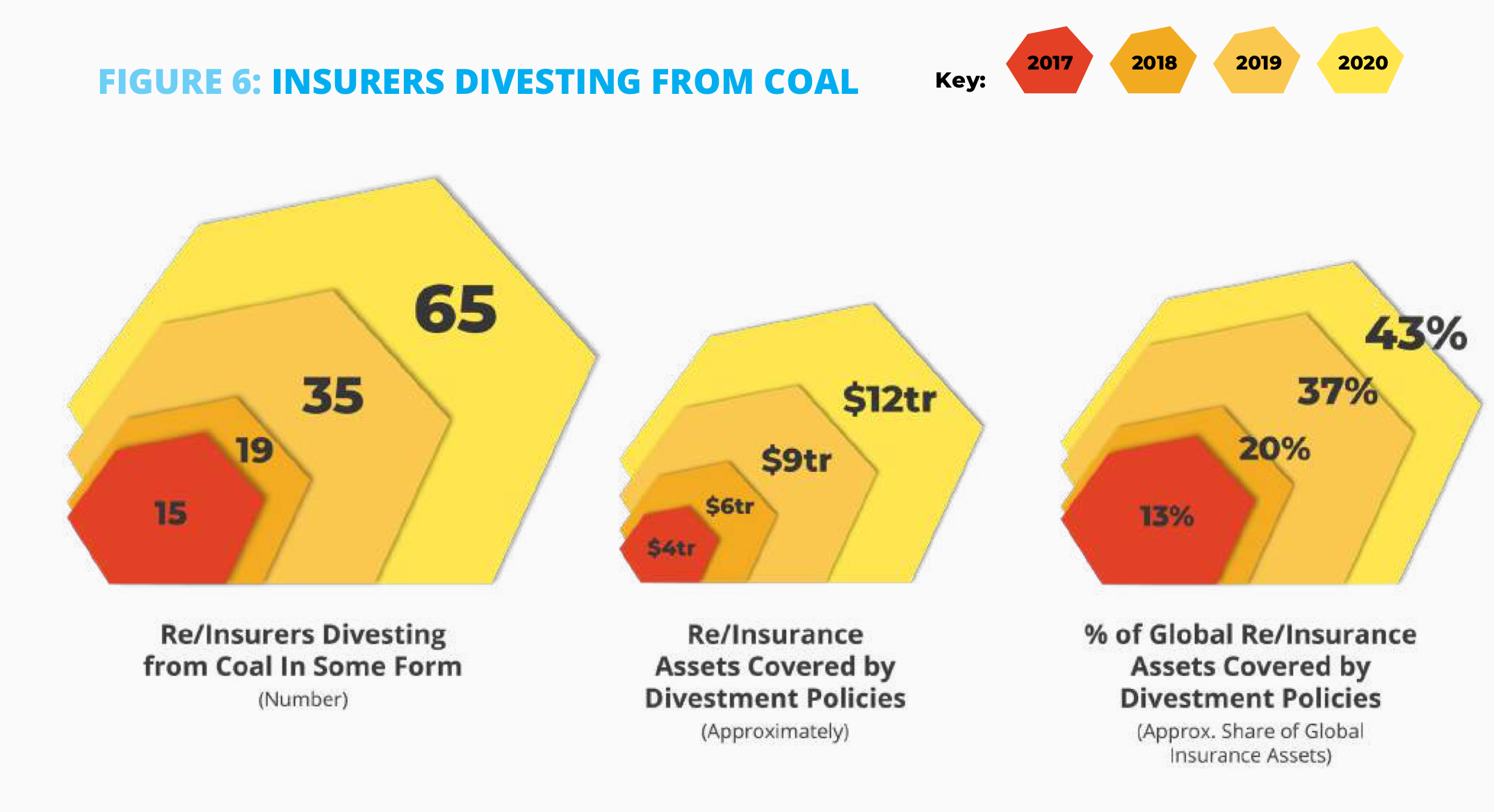

“Insurance and reinsurance companies have shown significant progress in divesting from fossil fuels or excluding them from the underwriting business in the last four years, as reported by ‘Insure our Future’“, comments Aurélie Baudhuin, chairman of SfC and deputy CEO of Meeschaert Asset Management, one of the network’s funding members. “However, most of them are still focussed on coal exclusion and on some ‘extreme’ fossil fuels such as tar sands, associated pipelines, arctic and deep-sea drilling. It is now time to extend this commitment to the whole oil sector and, progressively, to natural gas as well“.