In 2024, the 20 members of the network, with a total of over €48bn AUM, jointly engaged 172 companies and one institution, most of them in Europe, filing resolutions and voting at annual general meetings (AGMs) or asking questions in conference calls, meetings and via mail. Most questions were on climate and environment issues, ESG[…]

Read more

At the end of November, the EU Defence Industrial Investment Forum, “Investing in the EU’s defence & security: a new political priority”, hosted by the European Commission’s Directorate-General for Defence Industry and Space (DG DEFIS), took place in Brussels and online. The aim was to discuss ‘how ESG barriers hinder the financing of defence companies and how these[…]

Read more

Ökoworld, an asset manager pioneer in the field of sustainable investment, joined SfC in December 2024. By joining Shareholders for Change, ÖKOWORLD is further expanding its engagement activities. ‘It carries more weight when 20 institutional investors act together and fight for positive change in companies,’ says the company in a press release. ‘We want to[…]

Read more

Vivendi’s spin-off project In December 2023, Vivendi – the media conglomerate which is part of the French stock index CAC40 – announced a new spin-off project consisting of the listing of the Canal+ branch on the London Stock Exchange, the Havas branch on Euronext Amsterdam, and its publishing activities through a holding (named Louis Hachette Group) on the Paris Euronext Growth[…]

Read more

The European Commission does not tolerate any other views: Weapons financing must be considered ‘sustainable’ Last week, the “EU Defence Industrial Investment Forum” took place in Brussels and online. The aim was to discuss how ESG barriers hinder the financing of defence companies and how these can be removed to encourage banks and investors[…]

Read more

On 12 November 2024, SfC members met with ICCR CEO Josh Zinner in a webinar. For over 50 years, members of ICCR – a coalition of over 300 global institutional investors representing more than $4 trillion in managed assets – have leveraged their role as shareholders to call for improved performance on critical environmental and[…]

Read more

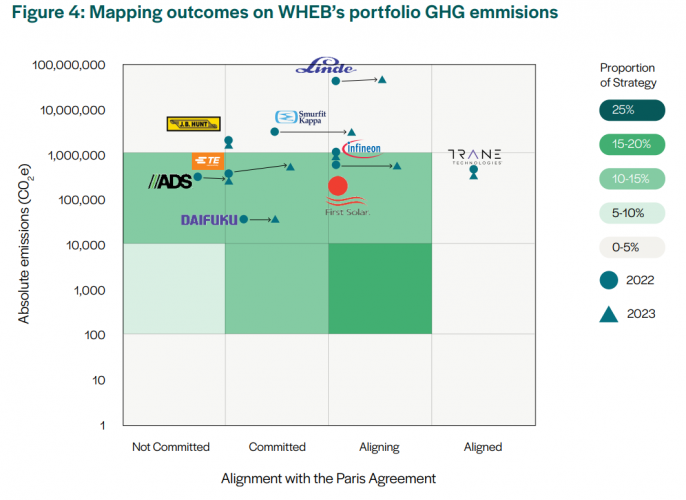

At the end of October, UK SfC member WHEB Asset Management issued a White Paper outlining the urgency for industry consensus on stewardship and engagement definitions and practices. The White Paper, entitled “From Obstacles to Outcomes: Enhancing effectiveness in stewardship and engagement”, aims to promote industry dialogue on the inefficiencies of shareholder engagement within[…]

Read more

The Swiss SfC member Ethos Foundation, together with DSW, the European association of private investors Better Finance, and the SfC network, has launched a new engagement campaign calling on Germany’s largest listed companies to stop holding virtual-only general meetings and to instead opt for a hybrid model. Together, the promoters represent more than €350 billion in assets under management. At the end[…]

Read more

As Shareholders for Change, we firmly believe in the “one share, one vote” principle. Therefore, in line with our previous commitment to preserving shareholder rights, we do not support the current development of European shareholder rights legislation. The Listing Act In December 2022, the European Commission published a series of proposals as part of the[…]

Read more

In June, at the annual summer meeting, SfC members met with representatives of three of the major rating agencies to discuss of the assessment process of companies involved in ESG incidents. In June, the members of Shareholders for Change gathered at the headquarters of Ethos Foundation in Geneva for the annual summer[…]

Read more