The SfC Summer Meeting 2025 provided an opportunity for in-person active engagement with Pirelli and to continue the discussion among SfC members of the critical shareholding working group. The engagement with Pirelli Pirelli & C. S.p.A. is an Italian multinational based in the city of Milan and one of the largest tyre manufacturers. During the meeting,[…]

Read more

On April 24, SfC – Fondazione Finanza Etica (FFE), an Italian member of Shareholders for Change (SfC), opened its 2024 critical shareholding season by speaking at the annual general meeting (AGM) of insurance giant Generali in Trieste. Representing also other SfC-affiliated investors — including ABS, Ecofi, FormaFutura, fair-finance, and Sanso — the foundation used the occasion to continue pressing Generali on[…]

Read more

Andrew Behar, CEO of As You Sow The importance of proxy voting continues to grow, particularly in light of increasing shareholder investment in mutual funds, both actively and passively managed, in the US and the EU. A key issue is the influence of proxy advisory firms, which guide institutional investors’ voting decisions. These firms have a[…]

Read more

On 31 January, Italian SfC member Fondazione Finanza Etica attended the annual general meeting of ThyssenKrupp as a representative of Shareholders for Change and together with the Dachverband der Kritischen Aktionärinnen und Aktionäre, the German critical shareholders association. ThyssenKrupp has always opposed the introduction of stricter internal assessments on arms exports and has never provided clear information to rule out[…]

Read more

In March 2023, Shareholders for Change alongside other 20 Swiss and international institutional investors sent a co-signed letter on Human Rights and Environmental due diligence to members of the Swiss Parliament. Our request was to adopt a comprehensive human rights and environmental due diligence legislation in Switzerland just like Germany did at the beginning of the year with[…]

Read more

Ökoworld, an asset manager pioneer in the field of sustainable investment, joined SfC in December 2024. By joining Shareholders for Change, ÖKOWORLD is further expanding its engagement activities. ‘It carries more weight when 20 institutional investors act together and fight for positive change in companies,’ says the company in a press release. ‘We want to[…]

Read more

On 12 November 2024, SfC members met with ICCR CEO Josh Zinner in a webinar. For over 50 years, members of ICCR – a coalition of over 300 global institutional investors representing more than $4 trillion in managed assets – have leveraged their role as shareholders to call for improved performance on critical environmental and[…]

Read more

Marco Carlizzi, Chairman of Etica Funds, spoke at the second Meeting of States Parties to the TPNW to read the Investor Statement and renovate the commitment to stop fundings for nuclear weapons Three questions to Marco Carlizzi, Chairman of Etica Funds The 2017 TPNW complements and reinforces the 1968 Non-Proliferation Treaty (NPT). What[…]

Read more

We asked this question to the SfC members who have been involved in the project during the AGM Season 2021. Mauro Meggiolaro, Fondazione Finanza Etica “We evaluated the decarbonisation plans of Eni, Shell and Total. All three are still vague and concentrate most decarbonisation efforts after 2030. How can the majority of shareholders be[…]

Read more

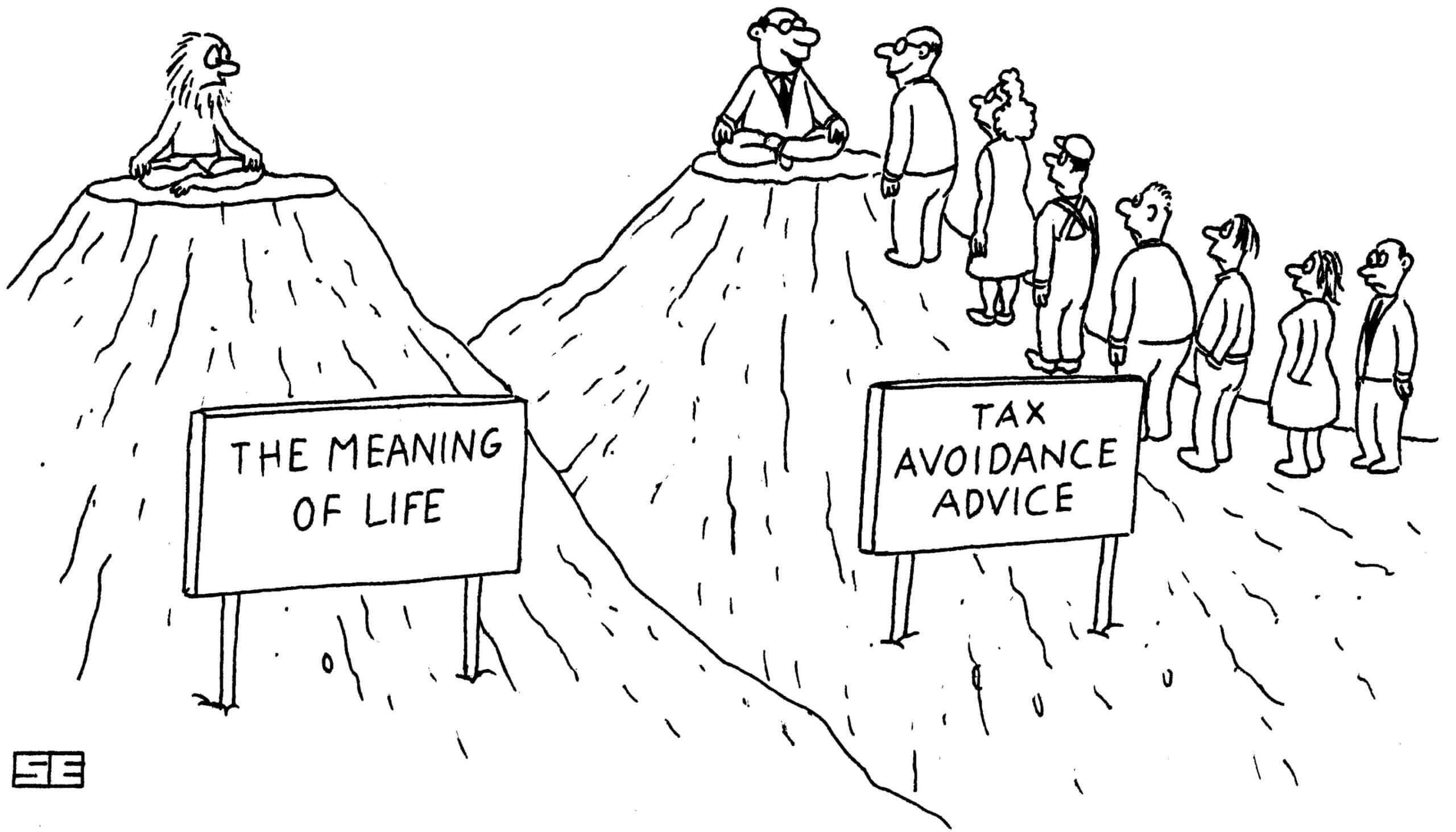

SfC made a donation to Tax Justice Network after hosting a seminar of its expert Tommaso Faccio In a seminar that was held in Madrid last December, Tommaso Faccio, researcher in the field of corporation tax at the Nottingham University and co-founder of Tax Justice Italia, explained to SfC members how the most recurrent[…]

Read more